Last updated: 10 February 2020

Please find below a summary of the income tax and social security contributions in 2020, which remain at the same level as in 2019.

The income tax remains 10%, knowing that certain categories of individuals are exempted from the payment thereof on salaries and revenues assimilated thereto (ex. software developers).

The tax benefit granted for the construction industry since the 1st of January 2019 is maintained, consisting of exemption from payment of the income tax and certain mandatory social contributions.

For the record, exemption benefit for the construction field is granted in accordance with the provisions of the article 60 (5) of the Tax Code, as modified by Government Emergency Orders no. 114/2018 and 43/2019. This exemption is granted for salary income obtained during the period 01.01.2019 - 31.12.2028, under certain conditions, namely:

- The employers carry out activities in the construction field as well as in other related areas expressly provided for by the article 60 (5) of the Tax Code;

- The yearly turnover resulting from performance of the activities corresponding to the NACE codes herein above referred to represents at least 80 % of the total turnover:

- For companies already incorporated on the 1st of January, the turnover taken into account is that of the preceding fiscal year, if the turnover represents at least 80% of the total turnover, employers will benefit of the tax facility for the entire year;

- For companies registered with the Trade Register after the 1st of January of the current year, the turnover since the beginning of the activity shall be considered, including the turnover of the month in which the exemption is granted ;

- For companies existing on January 1st, but whose turnover resulting from the performance of the above mentioned activities does not represent at least 80% of the total turnover for the preceding fiscal year, the turnover from the beginning of the year is taken into account including the month in which the exemption is granted;

The tax due by employees shall be determined and paid up by the employers in the same way, meaning by deduction of a withholding tax to be paid up directly to the state budget.

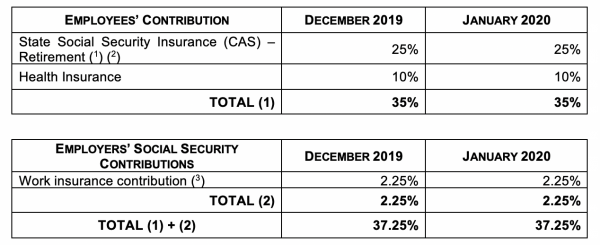

Please find below the table of the social security contributions applicable as of the 1st of January 2020:

(1) This rate includes the 3,75% rate corresponding to the privately-administrated pension fund; according the new legal provisions, a person who has been contributing to the privately-administrated pension fund, after a 5-year participation can choose either to continue to pay their 3,75% contribution to that fund or to direct it to the public pension fund. Take note that in the specific case of employees of employers performing activities in the construction field the CAS rate is reduced by 3,75% resulting in a 21,25% rate applicable from 01.01.2019 to 31.12.2028.

(2) As of the 1st of January 2018, for employees working in specific and special conditions, employers are bound to pay CAS contribution amounting to 4%, respectively 8% of the gross income obtained by the employee.

(3) Employers performing activities in the construction field and related fields shall pay a contribution amounting to 15 % of the standard work insurance contribution (2,25%).

In addition, please also note that starting from the 1st of January 2020, the guaranteed gross minimum wage at the national level increased from RON 2,080 (around 435 €) to RON 2,230 (around 466 €) for a full-time job. For employees hired for positions that require university studies and who have a seniority of at least one year in the field the guaranteed gross minimum wage at the national level remains of RON 2;350 (around 491 €).

Moreover, the guaranteed gross minimum wage at the national level remains of RON 3,000 (around 627 €) for the employees of the employers carrying out activities in the construction field (construction; manufacturing of construction materials, architecture, engineering or technical consulting, etc.).

Please take note that the average gross wage provided for 2020 under the law on the state social insurance budget is RON 5,429 (around 1,136 €).